Published On: Jan 18, 2015

With the advent of various on-going reforms in Power Distribution industry, electrical power quality is emerging as the key concern for all stakeholders, i.e. utilities, industrial customers, manufacturers and end-users. Power Quality is increasingly becoming a matter of concern in the power supply to consumers. Although all State Regulators in India has introduced Standards of Performance and Code of supply, however these are not enforced to a large extent because of their non-visible nature, non-awareness by the consumers, relatively new parameters (like harmonics and flicker) due to more and more solid state or electronic devices appearing in the high voltage electric grid and distribution system etc. The business risks posed due to PQ issues are a real one with even ‘low tech’ industries exposed to major financial losses. Further, PQ issues get escalated due to lack or no measurement and monitoring of its indices on a regular basis.

PQ issue causes production loss for high-end industrial customers, revenue loss for the utility operators, extra maintenance cost of the affected equipment, blocked capacity restricting usage of capital investment etc. and thus has significant techno-economic consequences for concerned stakeholders. Utilities and customers are not aware of the economic impacts due to poor PQ, as it is not properly assessed due to lack of periodic power quality monitoring and evaluation. This ignorance about economic loss has also affected the availability of financing options, which require clear cost-benefit analysis, to mitigate poor PQ.

This blog attempts to showcase the potential financing options for PQ mitigation investment, including some real life case study of PQ investment and its benefits accrued to concerned industry and service sector.

FINANCING ECOSYSTEM FOR PQ MITIGATION

The economic analysis of investments is one of the fundamental steps in any financial decision process. Unlike Energy Efficiency (EE) or Capital Investment for any improvement in output by high-end industries or utilities, PQ mitigation investment decisions suffer from a natural barrier, as its economic impact is not regularly measured or evaluated. The cost and its associated losses due to poor PQ are very high for businesses and it is continuously rising in today’s sensitive industrial processes. Hence, it is utmost important now that utilities and customers adopt proper impact analysis so as to enabled suitable financing mechanism for PQ mitigation.

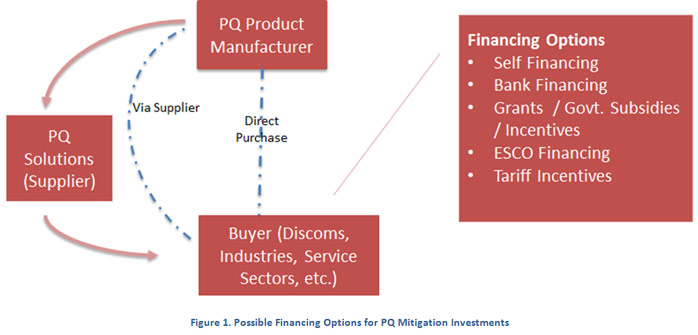

Below rich picture depicts possible financing options for PQ equipment buyer:

The various possible financing options are explained below briefly:

- Self-Financing: It is an investment option where PQ equipment buyer (i.e. utility or industry) invests on its own for power quality mitigation equipment. Distribution companies, in order to improve power supply quality, makes its own investment in the network infrastructure and file it in Aggregate Revenue Requirement (ARR) for recovery from customers as a tariff component. High-end industries (those who recognizes PQ issues and it’s impacts in their plants) do a detailed PQ audit with the help of professionals and experts, evaluate the potential saving from PQ mitigation and make their own investment. Below case study of Usha Martin show this scenario, wherein the industry was able to achieve Return on Investment (RoI) in only 7 months. This is the most prevalent financing option as it is directly related to revenue loss for utilities and production loss for industries. Also, this option is faster in terms of implementation as compared to others as there are no externalities associated with the financing.

- Bank Financing: One of the promising options for PQ mitigation investment is Bank Financing. High-end industrial units can avail loans from banks and repay debts from savings achieved and increased production. Most industrial units already procure loans from Bank during the setup and installation phase of their plant. Hence, this option can be further leveraged for green field PQ mitigation investment, often a fraction of total capital investment, to reduce the burden of future self-financing.

- Grants / Govt. Subsidies / Incentives: Another option is financial assistance from Government bodies to utilities in terms of grants/subsidies (similar to Solar) for power quality improvement. Considering the importance of power quality and its correlation with AT&C losses, an incentive mechanism could be made available to utilities. Similarly, there could be an incentive for high-end customers for maintaining harmonics distortion level within prescribed limits as per standards. However, this option has limited applicability in India (as of now).

- ESCO Financing: Power Quality and Energy Efficiency (EE) goes hand in hand. Energy service companies (ESCO) financing model is another potential financing options for energy savings project in the country. An ESCO assesses the efficiency and savings opportunity and purchases necessary equipment to improve performance. Most ESCOs also provide financing option and in return takes some part of the savings achieved as their consultation fees. This may take some time to mature towards ESCO model for financing.

- Tariff incentives: Regulators could allow an increase in tariff as an incentive for the discom to drive certain PQ related improvements. Some countries allow higher recovery rates to be applied if a discom is able to meet certain PQ performance parameters and/or surpass them. Such incentives could help accelerate adoption of PQ mitigation equipment.

PQ mitigation investment options need to be evaluated in a systematic manner considering the financial impacts of PQ issues by all stakeholders involved and the costs associated with different alternatives to improve PQ performance. The selection of an optimum mitigation method is a big decision for utilities and high-end industrial customers. PQ mitigation investment should be considered as insurance coverage rather than only investment approach, as it prevents highly sensitive equipment from high losses in the long run.

“Investing in PQ mitigation equipment is possible provided industries and service sectors are aware of the techno-economic consequences caused due to poor PQ. Further he added that bank financing could be best possible option (provided it is hassle free) as there is no direct burden on company’s cash flows.”

Mr. N. K. Jain Senior PQ expert

CASE STUDY 1 – REDUCTION IN BREAKDOWN AND ENERGY CONSUMPTION BY REDUCING HARMONICS AT USHA MARTIN (INDUSTRY SECTOR)

Problem Statement: Usha Martin is India’s largest and world’s second largest steel wire rope manufacturer. Steel wire manufacturing involves number of DC motors and AC to DC convertors. Various manufacturing process like surface treatment, galvanizing, etc. are adopted during the making of wire rope. In the process, numbers of motors (equipped with drives) with different capacities are used. The unit noticed presence of harmonics in the system, which caused problems like additional heat generation in cables, increased failure rate of equipment, increased consumption due to higher losses and nuisance tripping of circuit breaker. A detailed study of the plant revealed that the transformers associated with ropery and wire mill processes were generating high harmonics.

Solution and Benefits: After carrying out the detailed study, the unit management came to a decision of mitigating harmonics by installing passive harmonic filter in the system. The passive harmonic filters were designed as per load current and order of harmonics. This has resulted in significant reduction in energy consumption (thereby resulting in monetary benefit due to reduction in energy cost), improved productivity due to reduced downtime and reduction in failure rate of electrical equipment.

Post implementation, the readings were recorded and compared to see the improvement achieved by eliminating harmonics in the feeder line.

The table below gives voltage and current THD comparison findings:

|

Location |

Without harmonic filter |

With harmonic filter |

Change (%) |

|||

|

V (THD) |

I (THD) |

V (THD) |

I (THD) |

V (THD) |

I (THD) |

|

|

Transformer – 1 |

12% |

21% |

2.10% |

11.20% |

↓9.9% |

↓9.8% |

|

Transformer – 2 |

15% |

0% |

1.20% |

7.20% |

↓13.8% |

↓52.8 |

The table below indicates change in annual failure rate before and after installation of harmonic filter:

|

Component |

Annual failure rate before Harmonic filter |

Extrapolated – Annual failure rate after harmonic filter |

Change |

|

Motors |

43 |

8 |

↓81% |

|

Drives |

52 |

8 |

↓85% |

|

PLC’s |

22 |

8 |

↓64% |

The table below shows the reduction in average electricity cost before and after installation of harmonic filter:

|

ACTUAL ELECTRICITY |

|||

|

|

Before Harmonic Filter |

After Harmonic Filter |

Change (%) |

|

Energy Consumption – kWh |

Rs.1 |

R |

↓6% |

|

Maximum Demand – |

Rs.9, 236.00 |

Rs.7, 872.00 |

↓14.77% |

Conclusion: The main aim of Usha Martin was to reduce the production cost. In order to reduce the production cost, reliable operation and efficient use of manufacturing process forms an integral part for any unit. The company made investment close to Rs. 1 Cr. by installing PQ equipment to mitigate the harmonics. This plan/strategy was highly paid in terms of various savings as mentioned above. The savings incorporated had the simple payback period of 7 months on investments. (For detailed case study, refer number 4 under References section)

CASE STUDY- HARMONICS MITIGATION IN A HOSPITAL AND ITS BENEFITS (SERVICE SECTOR)

Problem Statement: One of the biggest hospitals in Southern India specializes in treatments of heart diseases, neurology, neuro-surgery, cancer and other life threatening diseases. The hospital has installed best available technology in terms of sophisticated medical equipment and electrical distribution system. The hospital was facing problems in their distribution system like higher temperature in the transformer, noise in the capacitor bank, disturbance on monitor screens of machines, higher energy charges, etc. It noticed the presence of high harmonics at point of common coupling (PCC), higher than 30% as per the limits set by standards.

Solutions and Benefits: After detailed power quality study, the hospital management decided to mitigate these harmonics by installing 120 Amp Active Harmonic Filter. This has resulted in significant reduction in energy consumption (thereby resulting in monetary benefit due to reduction in energy cost), improved services and diagnosis capabilities due to reduction in harmonics. Post installation study was carried out to analyze the benefits achieved by installing active harmonic filter.

The table below shows the results of study before and after installation of harmonic filter:

|

Component |

Before Harmonic Filter |

After Harmonic Filter |

Change |

|---|---|---|---|

|

Total Harmonic Distortion (THD) |

25% |

5% |

↓ 80% |

|

Power Factor |

0.97 |

0.995 |

↑ 2.5% |

|

Avg. kVA |

180 kVA |

204 kVA |

↓ 5.55% |

|

Transformer Temperature |

80-1800C |

450C |

↓ 47% |

Conclusion: By investing Rs. 750,000 and installing PQ mitigation equipment, hospital management gained substantial monetary benefit in terms of reduced electricity charges and improved services to its patients. The strategy worked out well and hospital had simple payback period of less than 1 year.

There is indirect benefit accrued to the concerned utility too in terms of lesser demand on their distribution system making its infrastructural capability to cater to higher number of customers.

(For detailed case study, refer number 5 under References section)

More similar case studies can be referred below:

- Distribution Network Voltage related power quality issues in a food and beverage industry

- Total Power Quality Management In An Automotive Component Manufacturing Unit

Above case studies clearly depicts that there are high potential savings for industries and service sectors from investing in PQ mitigation.

RURAL ELECTRIFICATION CORPORATION (REC) EXTENDS FUNDING FOR IMPROVEMENT IN DISTRIBUTION POWER QUALITY

Power availability and quality supply is a big issue in rural India. Rural agricultural customers are mostly dependent on farming and availability of quality of power is a continuous challenge for them. Proper voltage supply is essential to irrigate fields as irrigation is mostly done from groundwater pumps. Agricultural pump sets are often supplied by long distribution lines, which are costly to build and have high line losses along with low voltage. The voltage fluctuations and poor voltage regulation or poor quality of supply significantly reduce the operating efficiency of electric pumps and even lead to burning of pump sets. Besides frequent imbalances in voltage supply are also a PQ issue affecting agricultural equipment.

In order to reduce the line losses in the system and improve the quality of power, Rural Electrification Corporation (REC) has extended financial assistance to State Electricity Boards (SEBs now DISCOMs)/State Power utilities. REC has formulated various Reactive Power Compensation (RPC) projects like High Voltage Distribution System (HVDS), Feeder Separation, and Automatic Power Factor Correctors (APFC) etc. to improve the Voltage Regulation. In addition, there are some tax benefits like Accelerated depreciation of 80% is available for using some electrical equipment like Flexible AC Transmission (FACT) devices and some other power saving devices under the Income Tax Act.

CONCLUSION

Power quality issues are becoming an important subject in power systems and receiving much more attention than in past. PQ issues cause a negative cash flow – i.e. they result in a cost – either continuously (as for example, excess power loss in a transformer due to harmonics) or in discrete events (such as an unmitigated voltage dip or the failure of a transformer due to long term overload caused by harmonics).

Further, it is a well-established fact that energy efficiency and power quality are strongly linked. Investment and Improvement in power quality helps reduce the T&D losses in the system and equipment. The stakeholders should consider availing various investment options for installing PQ mitigation equipment to address their PQ issues. Installation of PQ mitigation equipment not only improves the quality of power but also the utilization factor of distribution infrastructure.

REFERENCES

- Cost Analysis and Reduction of Power Quality Mitigation Equipment – EPRI solutions Technical Report, December 2000

- A guide for the management of the economics of power quality –Nazineh G.EASSA Alexandria Electricity Distribution Company- Egypt, June 2011

- Investment Analysis For PQ Solutions – – Angelo Baggini & Franco Bua, July 2004

- Case Study 1 – Reduction in breakdown and Energy Consumption by Reducing Harmonics at Usha Martin (Industry).

- Case Study 2 – Harmonics Mitigation in a Hospital And Its Benefits (Service Sector).